|

|

Staff Access

Basic Needs

Health Care Coverage

ConnectorCare

ConnectorCare Advocacy Guide, Mass Law Reform Institute, 5/19

Open Enrollment

In MA Open Enrollment is generally November 1 to January 23 the following year (or any time a year for those eligible for subsidies, or who experience a qualifying life event). (Note: Open Enrollment ends earlier in most other states - ending December 15.)

If someone loses access to MassHealth coverage, it is considered a loss of coverage and a Qualifying Life Event that triggers a Special Enrollment Period (SEP) for Health Connector Coverage.

A SEP means that someone can enroll in or change health insurance plans outside the annual Open Enrollment period. Beginning on 4/1/23, anyone who receives a SEP for any qualifying life event will have their enrollment window extended to 11/23. Other life events that let someone qualify may include:

- Changes in household make-up, income, immigration status, or address

- Certain other life changes, like getting married, having a baby, or losing job-based health insurance

More information: Connector Special Enrollment Period Extended (MGH Community News, March 2023) and previous coverage: MGH Community News, October 2019.

ConnectorCare is the Massachusetts health plan type that replaced Commonwealth Care and Commonwealth Choice as part of bringing the state into compliance with the federal Affordable Care Act.

For more detailed information and to apply:

MGH patients should contact Patient Financial Services (617-726-2191).

MAHealthConnector.org (Warn patients to be careful of bogus connector websites- one tip: look for .org or .gov endings on websites) also see Contact list- phone & fax

Member Booklet (Large Print version.)

- Combined member booklet for MassHealth, the Children’s Medical Security Plan (CMSP), ConnectorCare Plans and Premium Tax Credits, and the Health Safety Net. To get this booklet in Cambodian, Chinese, Haitian Creole, Laotian, Brazilian Portuguese, Russian, Vietnamese, or in Braille please call MassHealth Customer Service at 1-800-841-2900 (TTY: 1-800-497-4648)

Eligibility

- Determining Income and Household Composition/Size: Modifided Adjusted Gross Income (MAGI)- The rules for determining income (what income is counted) and who is in the household (which is part of the income limit calculation) is more complicated under the Affordable Care Act.

- This calculation should be done seemlessly as part of the application process. But it is important to know that for many under age 65, one cannot just look at a chart, include the number of people living together and determine eligibility.

- Household composition is based on how one files taxes and whether one claims any dependents or is claimed by others as a dependent. Different members of the family may be considered to have different numbers of people in their household. One may have members in one's household that do not live under the same roof.

- The new MAGI 5% income disregard does not apply to ConnectorCare plans (only applies to MassHealth)

- At application one must give best guess as to income and how one will file taxes for the upcoming year. (See Advanced Premium Tax Credits and Reconciliation.)

- For more information: see detailed MAGI Powerpoint.

- ConnectorCare income limit (same as the old Commonwealth Care program)- 300% FPL. HOWEVER since open enrollment begins in November of the previous year, that previous year's FPLs are used through most of the following calendar year. See 2nd page of health insurance income grid (and please read the notes at the bottom of the grid)

- Note: Connector Care also has an income FLOOR- 100% FPL. (The Connector only began to apply the 100% FPL income floor rule for decisions made after the summer of 2015.)

- One exception- lawfully present immigrants who do not qualify for Medicaid under its more restrictive immigrant eligibility rules (like legal permanent residents subject to the 5 year waiting period).

- The people affected: seniors who are not enrolled in Medicare (Medicare enrollees are never eligible for ConnectorCare) with low income, but assets over the $2000/$4000 asset standard for MassHealth for seniors (and who are US citizens or Qualified immigrants).

- Or put another way, while the Health Connector doesn't have age restrictions when determining eligibility for subsidies, ConnectorCare coverage is only available to those with income under 100% FPL if they don't qualify for MassHealth because of their immigration status. Immigrants who are lawfully present, but don't qualify for MassHealth can get ConnectorCare if their income is under 100% FPL, regardless of their age.

- Example: An individual age 65 or over who is retired and a citizen, but not eligible for Medicare. Her income is below 100%, but her assets are over $85,000. She does not qualify for ConnectorCare because her income is below 100%, and she does not qualify for MassHealth because she is over the asset limit.

- It is still important for these individuals to complete a subsidized application to get access to Health Safety Net benefits

- More information:

- Income Limit Changes for 2024

- Two Year Pilot expands income limit to 500% FPL for no deductible, no coinsurance and sliding scale co-pays

- MA Lawmakers included in the FY24 budget a two-year pilot program to expand the income limits for ConnectorCare from 300 percent of the federal poverty level to 500 percent. An individual making 500 percent of the federal poverty level has an annual income of $72,900, and a family of four brings in $150,000, according to the U.S. Department of Health and Human Services.

- The open enrollment period for 2024 coverage through the Health Connector will begin on Nov 1, and starting very soon the Health Connector will begin its annual redetermination process for its existing members to renew their coverage in 2024. It looks like the new pilot will be ready for Open Enrollment 2024.

- People with income from 300-500% FPL are already potentially eligible for federal premium tax credits to lower the costs of coverage through the Health Connector. (The Inflation Reduction Act lifted the statutory cap of 400% FPL through calendar year 2025). The Health Connector’s “Get an Estimate” tool shows the range of coverage options available today. However, for people with income over 300% FPL, available coverage often meant sizable deductibles and other out of pocket costs. ConnectorCare offers the added benefit of a standardized plan, with no deductible or coinsurance, and copays on a sliding scale basis that are currently based on three income tiers: nominal drug copays for people with income of 100% FPL or less, and higher copays for people with income of 100-200% FPL and 200-300% FPL.

- More information: See the full WWLP.com story

- (Federal subsidies up to 400% FPL- People with incomes between 300-400% FPL (see p 2) may be able to get help paying for health insurance (in form of Advanced Premium Tax Credits). Note: 2015 FPL in effect for this program until next Open Enrollment- November 15, 2016.

- Must meet federal eligibility guidelines (state resident, appropriate immigration status, not incarcerated, etc.), and must not have access to "affordable" employer-sponsored insurance.

- Choice of all plans offered through the Connector)

- Legal Immigrants- under pre-existing federal law, many legal immigrants are not eligible for MassHealth during the first 5 years of gaining legal status. These legal immigrants ARE eligible for ConnectorCare (as they were eligible for Commonwealth Care). So legal immigrants with income up to 300% FPL may qualify.

- Advocacy tip- Remember that cerrtain legal immigrants such as asylees and refugees, and those with legal permanent resident status (green card holders) who adjusted to that status from asylee or refugee status are NOT subject to the 5-year bar. So if they otherwise qualify they may be eligible for MassHealth.

- Undocumented immigrants remain ineligible for ConnectorCare as they were ineligible for Commonwealth Care. Undocumented immigrants may be eligible for MassHealth Limited and/or Health Safety Net.

- People with access to employer-sponsored insurance (ESI) that is not "affordable" may be able to access ConnectorCare, as may those who have access to a student health insurance plan.

- Affordability- According to federal rules, employer-based coverage is affordable if a worker's share of the monthly premium for an individual plan is not greater than 9.5% of the worker's income. The cost of a family plan, which is much higher than the cost of an individual plan, has previously not been taken into account, however, known as the "family glitch" - this has been corrected for plan year 2023.

- It is important to understand that the federal goverment is picking up part of the cost (in form of "Advanced Premium Tax Credits"). So some federal rules apply and some processes will be different.

- Medicare members should NOT purchase plans through exchanges - these are for those under 65. Learn more.

Coverage and Cost-Sharing

- The state has made a commitment to invest to make ConnectorCare as similar to Commonwealth Care as possible in terms of:

- Premiums

- Cost-sharing

- Benefits

Plan choices and

- Provider networks

- See Comparison Chart: Connector Care Benefits and Co-Pays

- Subset of carriers will offer ConnectorCare plans:

- BMC Health Net

- CeltiCare

- Fallon

- Health New England*

- Minuteman Health**

- AllWays Health Partners (formerly Neighborhood Health Plan)

- Network Health

*Currently only offered in MassHealth

**New plan in MA

- Plans accepted by MGH/Partners Healthcare- Under ConnectorCare, to continue to receive care here, patients would need to select AllWays Health Partners (formerly Neighborhood Health Plan). Please see this document for specific insurances transitioning from, their new coverage and which plans to choose if they wish to continue to receive care at MGH/Partners: PHS Transition Guide. Also- *2015 Plan Names and PHS Plan Participation (Also see: all payers on MGH Payer Grid, MGH contracts SharePoint from MGH Practice Support)

- *NOTE: Tufts is no longer using Network Health in the name of its MassHealth and Connector Care Managed Care plans. Its MassHealth plan is called Tufts Health Plan Together and its ConnectorCare plan is called Tufts Health Plan Direct. Unlike most of the other MassHealth and ConnectorCare MCOs, Tufts does not have the same providers available in its public plans as in its commercial plans. This is likely to cause confusion for enrollees who picked Tufts because their provider said they accept it, but in fact only accept the Tufts commercial plans not its public plans.

- Selecting a plan

- No automatic assignment, applicant must select a plan and pay premium if any due for coverage to begin.

- Applicants under 300% FPL can choose any “metal” tier plan (Bronze, Silver, Gold, Platinum- increasing premiums and coverage) BUT added state subsidies lowering premiums & cost sharing to Commonwealth Care levels are only available for ConnectorCare plans.

- “Bronze trap”-least expensive plan can be tempting, but high cost-sharing can leave one with significant costs in event of illness. Also these plasn are not eligibible for state subsidies for premiums and co-pays.

- Plans accepted by MGH/Partners Healthcare- Please see this document for specific insurances transitioning from, their new coverage and what options patients should select if they want to continue to receive care at MGH/Partners: PHS Transition Guide Also see - 2015 Plan Names and PHS Plan Participation (Also see: all payers on MGH Payer Grid, MGH contracts SharePoint from MGH Practice Support)

- Comparison Chart: Connector Care Benefits and Co-Pays

- Enrollment- under federal rules enrollment should be limited to Open Enrollment period or when one experiences a "triggering" life event (such as marriage, birth of child, loss of other coverage).

- Enrollment and Those Eligible for HSN- People notified that HSN will end March 31 have until March 31 to enroll in ConnectorCare (must enroll by March 23 to have ConnectorCare for April 1; if they enroll March 24-31, will not have ConnectorCare until May 1 but HSN should continue until May 1). For people found eligible for ConnectorCare after Jan. 31, 2016, they will receive reminder that HSN will end if they do not enroll in ConnectorCare by deadline. -->

Premiums (see pilot for 2024 changes) -No automatic assignment, applicant must select a plan and pay premium if any due for coverage to begin. Costs are the same as under Commonwealth Care: No premiums for those under 100% FPL (Plan Type 1). For those over 100% FPL up to 300% FPL – minimum premium contribution for lowest cost plan, but premium higher if choose higher cost plan.

- Premium Non-payment

- After 30 days nonpayment, tax credits to plan suspended & plan suspends payments to providers

- If back premiums not paid after 90 days, benefits terminated retroactively to end of first 30 days

- Connector has process to apply for a premium hardship waiver (Same as under Commonwealth Care)

- Proposed rule: 30 days from termination to reinstate coverage by paying all arrears (proposed rule 956 CMR 12.12)

- Unlike Commonwealth Care, the Connector will no longer be able to offer payment plans to members.

Advanced Premium Tax Credits- these are paid directly to the insurer to reduce costs of premiums. Members may choose instead to pay the full premium and receive the credit as a tax refund after filing taxes.

- To qualify for these tax credits

- One must file taxes for the year in which benefits are received.

- Those, such as some legal immigrants (Aliens with Special Status), who have low enough income that they wouldn't ordinarily need to file taxes, must do so to get the credits.

- Married couples must file jointly to be eligible for tax credits.

- Reconciliation- it is even more important than ever to report any changes in income, household composition, etc. in a timely manner. When one files taxes for the year in which one received benefits/tax credits the federal government will "reconcile" income with the tax credits provided. If one's income increased over the year, for example, one may have to pay back any tax credit over-payments.

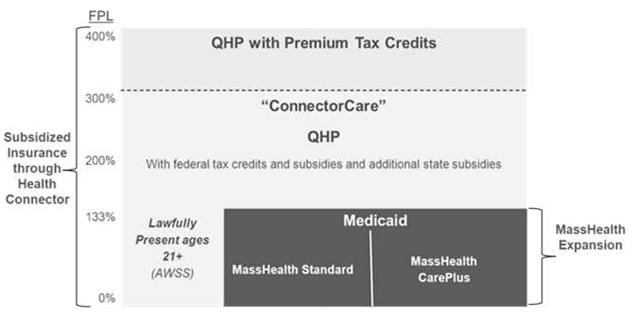

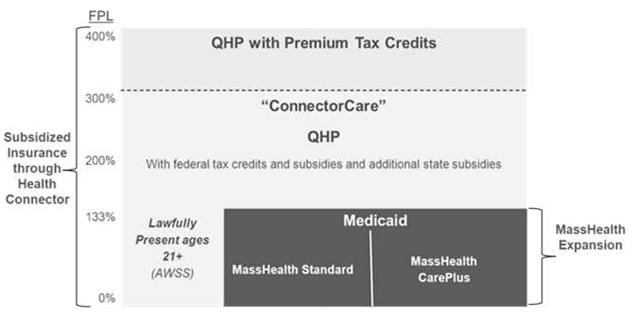

New MA ACA Subsidized Health Coverage Landscape

Glossary

QHP= Qualified Health Plan

AWSS= Aliens with Special Status (legally present, but not MassHealth eligible such as subject to the 5-year bar)

|